Berita Terkait

- Anggaran DPR RI Tahun 2016-2018

- Kehadiran Anggota DPR Pada Masa Sidang Ke-2 Tahun 2017-2018

- Review Kinerja DPR-RI Masa Sidang ke-2 Tahun 2017-2018

- Fokus DPR Masa Sidang ke-3 Thn 2017-2018

- Konsentrasi DPR Terhadap Fungsinya Pada Masa Sidang ke - 3 Tahun 2017 – 2018

- Kehadiran Anggota DPR RI Masa Sidang ke-3 Tahun 2017-2018

- Review Kinerja Masa Sidang Ke-3 Tahun 2017-2018

- Konsentrasi DPR Terhadap Fungsinya Pada Masa Sidang ke - 4 Tahun 2017– 2018

- Peristiwa Menarik Masa Sidang ke-4 Tahun 2017-2018 (Bidang Legislasi)

- Peristiwa Menarik Masa Sidang ke-4 Tahun 2017-2018 (Bidang Pengawasan)

- Peristiwa Menarik Masa Sidang ke-4 Tahun 2017-2018 (Bidang Keuangan, Lainnya)

- Review Kinerja DPR-RI Masa Sidang ke-4 Tahun 2017-2018

- (Tempo.co) Kasus Patrialis Akbar, KPPU: UU Peternakan Sarat Kepentingan

- (Tempo.co) Ini Proyek-proyek yang Disepakati Jokowi-PM Shinzo Abe

- (Tempo.co) RUU Pemilu, Ambang Batas Capres Dinilai Inkonstitusional

- (Media Indonesia) Peniadaan Ambang Batas Paling Adil

- (DetikNews) Besok Dirjen Pajak Panggil Google

- (Tempo.co) Aturan Komite Sekolah, Menteri Pendidikan: Bukan Mewajibkan Pungutan

- (Rakyat Merdeka) DPR BOLEH INTERVENSI KASUS HUKUM

- (Aktual.com) Sodorkan 4.000 Pulau ke Asing, Kenapa Pemerintah Tidak Menjaga Kedaulatan NKRI?

- (RimaNews) Pimpinan MPR dan DPR akan bertambah dua orang

- (Warta Ekonomi) Jonan Usulkan Kepada Kemenkeu Bea Ekspor Konsentrat 10 Persen

- (Tempo.co) Eko Patrio Dipanggil Polisi, Sebut Bom Panci Pengalihan Isu?

- (TigaPilarNews) DPR Harap Pemerintah Ajukan Banyak Obyek Baru untuk Cukai

- (Tempo.co) Menteri Nasir: Jumlah Jurnal Ilmiah Internasional Kita Meningkat

Kategori Berita

- News

- RUU Pilkada 2014

- MPR

- FollowDPR

- AirAsia QZ8501

- BBM & ESDM

- Polri-KPK

- APBN

- Freeport

- Prolegnas

- Konflik Golkar Kubu Ical-Agung Laksono

- ISIS

- Rangkuman

- TVRI-RRI

- RUU Tembakau

- PSSI

- Luar Negeri

- Olah Raga

- Keuangan & Perbankan

- Sosial

- Teknologi

- Desa

- Otonomi Daerah

- Paripurna

- Kode Etik & Kehormatan

- Budaya Film Seni

- BUMN

- Pendidikan

- Hukum

- Kesehatan

- RUU Larangan Minuman Beralkohol

- Pilkada Serentak

- Lingkungan Hidup

- Pangan

- Infrastruktur

- Kehutanan

- Pemerintah

- Ekonomi

- Pertanian & Perkebunan

- Transportasi & Perhubungan

- Pariwisata

- Agraria & Tata Ruang

- Reformasi Birokrasi

- RUU Prolegnas Prioritas 2015

- Tenaga Kerja

- Perikanan & Kelautan

- Investasi

- Pertahanan & Ketahanan

- Intelijen

- Komunikasi & Informatika

- Kepemiluan

- Kepolisian & Keamanan

- Kejaksaan & Pengadilan

- Pekerjaan Umum

- Perumahan Rakyat

- Meteorologi

- Perdagangan

- Perindustrian & Standarisasi Nasional

- Koperasi & UKM

- Agama

- Pemberdayaan Perempuan & Perlindungan Anak

- Kependudukan & Demografi

- Ekonomi Kreatif

- Perpustakaan

- Kinerja DPR

- Infografis

(Jakpost)Op-Ed: Jokowi’s fight for enlarged fiscal space through the fuel hike [by Mr.Winarno Zain]

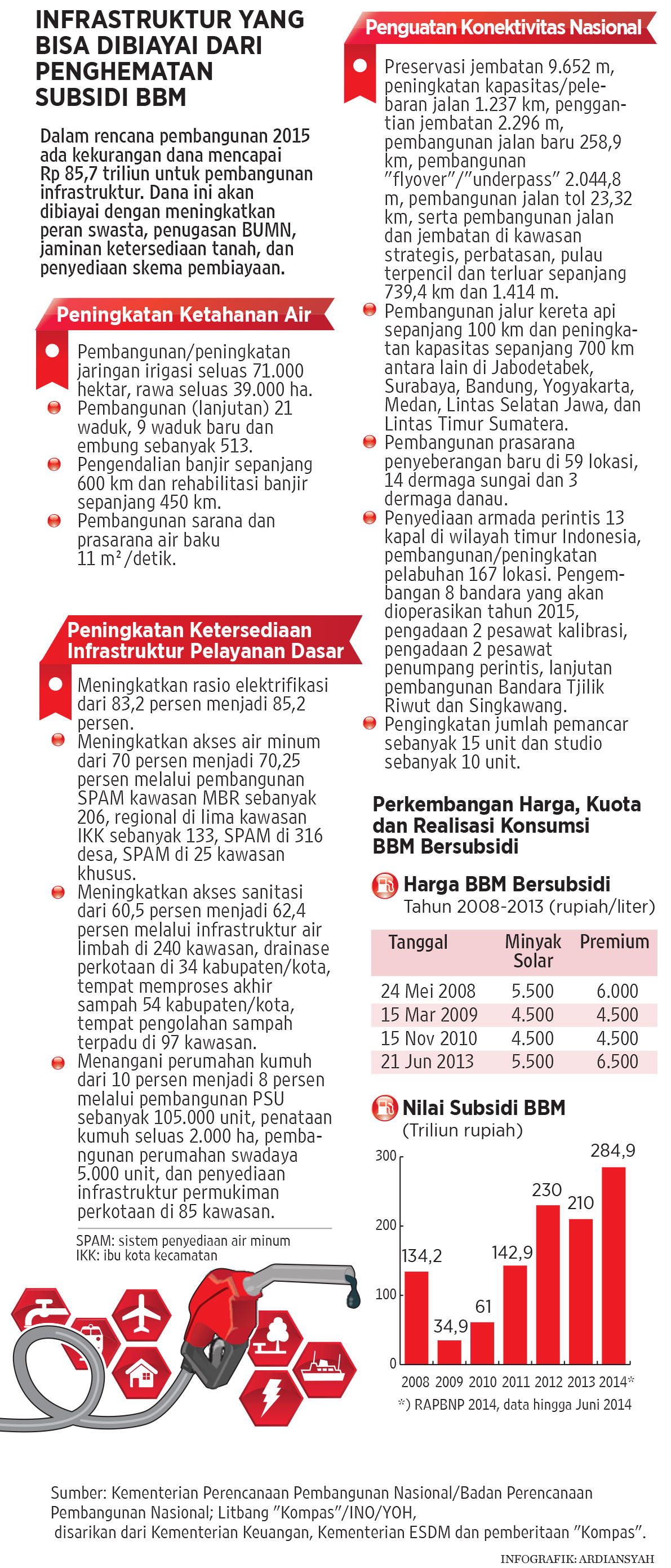

President Joko “Jokowi” Widodo’s decision to raise subsidized fuel prices for gasoline and automotive diesel by 30 percent and 36 percent, respectively, was a signal that he is serious about subsidy reforms. It was also his first major policy decision since assuming the presidency last month.

He knew that the move risked undermining his popularity, but he said he was ready to be unpopular. During the campaign he said fuel subsidies should be eliminated within four years.

With an additional Rp 100 trillion in savings generated by higher fuel prices, President Jokowi will have larger fiscal space in the 2015 state budget to improve the quality of government spending, redirecting it from wasteful subsidies to projects that support his signature programs, such as infrastructure (including maritime infrastructure), health and education.

The significant drop in oil prices recently should also provide more fiscal space.

The short-term effects of fuel-price increases on the economy and on various income groups have to be managed carefully by the government. Financial protection and other social safety net schemes for the poor and the vulnerable have been given immediate attention, but this is not something new for the government.

The government has had plenty of experience in the past implementing these schemes after fuel-price increases.

In fact, the implementation of social protection for the poor this time should be better with the help of information technology (IT). Any glitch in the IT that affects the program should be addressed immediately.

The immediate effect of the fuel-price hike will be higher inflation. Inflation has been benign in recent months by Indonesian standards. It dropped from 7 percent in May to 4 percent in August 2014, but it crept up again to 4.5 percent in September and to 4.8 percent in October.

The low inflation was largely attributable to the low rate in food inflation, which fell from 7.2 percent in May to as low as 1.8 percent in August.

But last month food inflation rose significantly to 5.2 percent. This is one area the government should watch closely.

Smooth supply and distribution of food should be ensured since any disturbance in these areas could have significant ramifications for inflation.

So critical is the effort to ensure food supply that the government should be ready to implement trade restrictions on food if required.

Inflation is forecast to rise to up to 7 percent after the fuel-price increase, but it will still adversely affect purchasing power, especially for those who are not rich enough to be insulated from inflation, but who are not poor enough to be entitled to social protection.

Their reduced purchasing power will slow down consumption, so far the main driver of economic growth.

Given the still weak level of exports, the hope for economic growth next year is that there will be more robust growth in government consumption and investment.

Investment has been weakening this year. Growth fell from 5.1 percent in the first quarter to 4.5 percent in second quarter and 4 percent in the third quarter. Net Foreign Direct Investment (FDI) was US$11.9 billion in the first nine months of the year, a drop of $1.2 billion, or 9.2 percent from the same period last year.

Revival of FDI growth will depend on how quickly Jokowi’s administration addresses obstacles in bureaucracy and infrastructure. It will also depend on the confidence investors have in President Jokowi’s ability to implement further reforms.

Growth will also need help from Bank Indonesia’s (BI) monetary policy. BI, which has been worried about the current account deficit and the health of the banking system, has maintained a tight monetary stance since last year.

Various restrictions imposed by the central bank on the banking system have curbed both monetary growth and bank-lending growth. Bank lending dropped from 24 percent in September 2013 to 13.5 percent in August this year.

This significant drop in bank-lending growth has significantly affected investment growth. And now, worried about rising inflation after the fuel-price increase and the anticipated interest-rate hike by the US Federal Reserve next

year that could trigger capital outflow, BI is expected to maintain its tight monetary policy next year, which would make it difficult for the government to pursue higher growth.

For Indonesia, fuel subsidies are not just a matter of social injustice or government budgeting: they are also a balance-of-payments issue. Since Indonesians consume more oil than the country can produce, oil imports keep rising, increasing the deficit in oil trade in the balance-of-payments.

In 2012, the oil deficit reached $23 billion. But in 2013, the deficit rose to $27 billion.

Through September this year the oil deficit reached $20.8 billion. It was responsible for the current-account deficit of $19.6 billion.

From this it is clear that the oil-trade deficit is the major factor in the worsening of Indonesia’s current account deficit. It is therefore important for the oil deficit to be reined in.

The fuel-price increase will prevent excessive consumption of fuel, reducing the need for imports, hence improving the balance-of-payments.

After fuel-price increases, painful adjustment cannot be avoided. And people will always ask whether their sacrifice was worth the economic benefit.

For the government, it is a matter of managing short-term pain to get long-term gain. After all, that is what regulating fuel prices is all about.

________________

The writer is a graduate of the school of economics at the University of Indonesia (UI) and a commissioner at a publicly listed oil and gas service company.